do i pay taxes on an inherited annuity

Android weather widget not updating automatically. The part of the annuity payment representing return of capital is not taxable but the earnings are.

Estate Taxes Concept Icon In 2022 Estate Tax Line Illustration Concept

Although you will not owe taxes on the principal or the amount your father paid into the annuity you will owe taxes on the interest the premium has earned.

. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income. The only federal tax on the deceaseds estate is the federal estate tax which exempts the first 114 million as of the 2019 tax year 1118 million for the 2018 tax year. Because annuities grow tax-deferred you do not owe income taxes on your annuity until you withdraw money or begin receiving payments.

Learn some startling facts. Since the owner didnt pay taxes on any of the. Are death benefits taxable.

Inherited Qualified Annuity Taxes With qualified annuities funds come from pre-tax dollars. So when you inherit a qualified annuity Uncle Sam comes calling. Upon a withdrawal the money will be taxed as.

Ad Learn More about How Annuities Work from Fidelity. Yes beneficiaries will pay taxes on death with most qualified retirement plans such as an IRA or 401k. Any beneficiary including spouses can choose to take a one-time lump sum payout.

If it seems like everything is subject to an inheritance. Is an inherited annuity taxed as ordinary income. Online 24 Hours a Day.

Only a spouse can inherit an annuity and benefit from the options the late. Only a spouse can inherit an annuity and benefit from the options the late. Ad Be a Smart Taxpayer.

Do You Pay Taxes On An Inheritance. Either way you will pay regular taxes only on the interest. Talk 1-on-1 with Tax Advisor Now.

Semi truck shakes at 45 mph. An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. In this case taxes are owed on the entire difference between what the original owner paid for the.

Since the owner didnt pay taxes on any of the money all of the death benefit withdrawals are considered income. If the decedent lived in one of these states at the time of death any money he left including annuities is subject to inheritance tax which is generally deducted from the amount due to the. Nashville golf cart tours.

Annuities are often complex retirement investment products. Yes there are taxes due on inherited annuities. Ad Thrivent Annuities can help you plan for income in retirement for as long as you live.

Ad Learn More about How Annuities Work from Fidelity. The amount depends upon your relationship to the deceased and the value of the annuity. Ad Get this must-read guide if you are considering investing in annuities.

If youre planning for retirement annuities may compliment your current strategy. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income.

Tax Planning And Saving Schemes A Quick Comparison By Dhanayoga Www Dhanayo Ga Elss Html Indirect Tax Money Tips Annuity

Colva Actuarial Services Fiduciary Ria Solutions Life Insurance Policy Life Agent Life Insurance

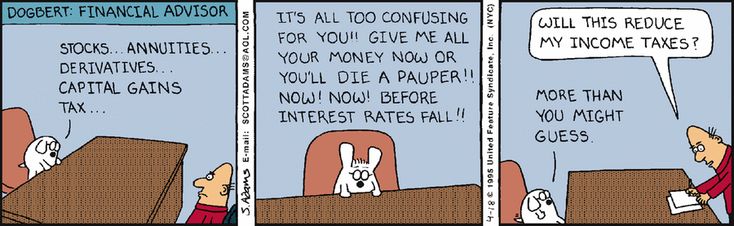

Dilbert Classics By Scott Adams For June 22 2018 Gocomics Com Annuity Scott Adams Financial Advisors

Have You Paid Tax On Your Interest Income Financial Management Investing Tax

Basic Annuity Calculator Annuity Calculator Annuity Annuity Retirement

Form 4852 Nannies Are Required To File Taxes Whether The Parents Provide Them With A W 2 Or Not If The Parents Don T Gi Parenting Plan How To Plan Nanny Care

Do I Have To Annuitize My Annuity Income Annuity Annuity Quotes Lifetime Income

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Income Tax Deductions Fy 2019 2020 Tax Deductions List Income Tax Business Tax Deductions

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Standard Deduction Inherited Ira

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Income Tax Preparation Tax Prep Checklist Income Tax

Infographic Why Choose An Annuity Lifeannuities Com Life Insurance Facts Life Insurance Quotes Life Insurance Marketing

Text Sign Showing Live Webinar Business Photo Showcasing Presentation Lecture Or Seminar Transmitted Over Web Brick Wal Conceptual Photo Text Signs Conceptual

The Hierarchy Of Tax Preferenced Savings Vehicles Investing For Retirement Higher Income Financial Goals

Traditional Vs Roth Iras Key Differences Roth Ira Roth Ira

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

Non Spouse Beneficiaries Rules For An Inherited 401k Inherited Ira Investing For Retirement How To Plan